Accept Checks By Phone

The easiest way to take a check, No Signature Required.

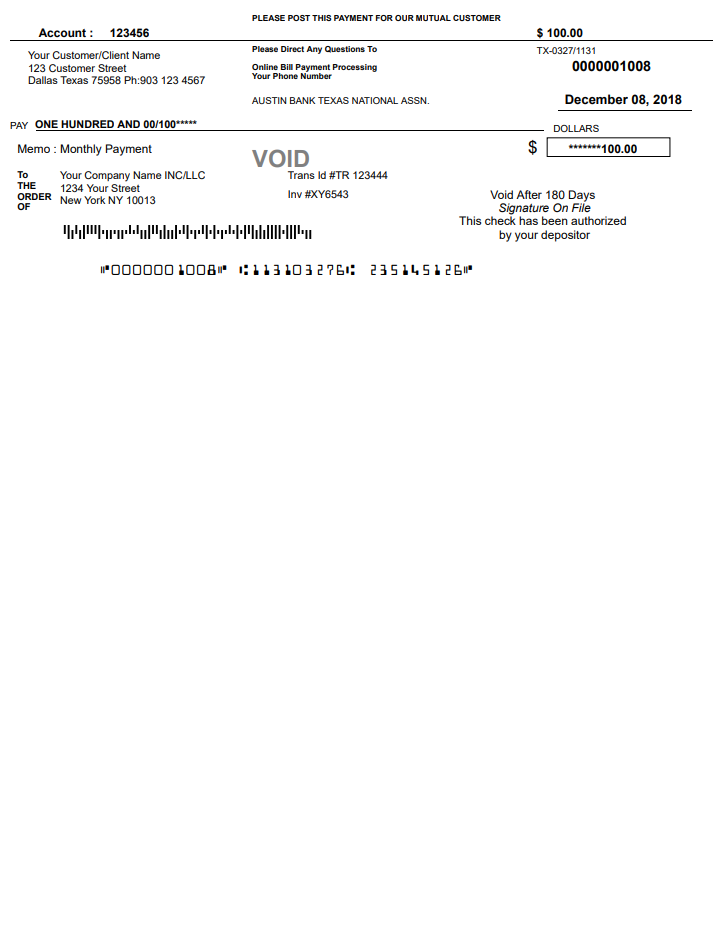

Cloud-based check Draft software. Print Check Draft in

Any Printer, Any Check Paper, Anywhere. Support Check on Top, Middle, Bottom, Three Per Page. Check Draft often Called Bank Draft or Demand Draft

One of the easiest way to get paid. Check by phone is a service provided by merchants, after getting the necessary authorization and Bank information Merchant print a paper check on behalf of payer which does not require your signature.

Any business can create a check draft. It is actually an authorized copy of a check. It is same as a check but printed by merchants on behalf of payers with proper permission. No Signature Required.

Results are you don’t have to wait for check in the mail, you don’t have to pay any kind of processing fee of credit card Companies.

How to Accept a Check by the Phone?

Banking regulations require some confirmations from clients for checks drafts. These avoid “the burden of proof” if a draft is disputed.

After you sell your item/Service, or any service agreement or Donation,

You get Clients’ Bank Account Number, routing number and verifiable authorization via Telephone/Web/Fax/Text/Link and keep this authorization safely in case any dispute comes. Authorization by a Link is recorded in your account however check and ensure. Enter that data to online Check Draft and print check Daft. Deposit this check draft just like a check to your bank. There is no any difference between check draft and check. Yet, check draft does not require a signature and you must have consent for that from them. We generally suggest having a paper trail like fax or text or email.

Check draft can be used for recurring, one-time or open payments according to the authorization you have. This is the easiest way to collect rent and other ongoing fees without any kind of processing or transaction fees..

Verbal authorization for check draft

Verbal Authorization that must be recorded or Authorization Mailed/Faxed/Emailed to Customer BEFORE the Draft is initiated.

Banking regulation requires some authorization from your clients before you print a Check Draft. This is to avoid any dispute and to have a proper business trust each other.

The Check21 definition https://www.fdic.gov/consumers/assistance/protection/check21.html states that a Check image reproduced cleanly in any paper is as valid as the original Check

Login From Anywhere

Our software is 100 % cloud-based. So you can log in from anywhere. You don’t need to download any software. Use OnlineCheckDraft.Com from anywhere, Macbook, Linux Operating System Even from your Phone. Do You know your data secured in the Industry leading Amazon Banking Grade server? We don’t want to take any risk on your valuable Data.

Feature : Online Check Draft Software

No Download required , could base Demand Draft software

Create multiple check Draft / batch check draft in one click

Every check Draft has its own statement

Print Deposit Slips also Online for the Checks Draft you created in one click.

Categorized Check Draft

Print check Draft from any Printer or Computer

Check Draft. Get paid over the phone, fax or web without any fee

Recurring Check Draft. Set it and will be ready to print at specified time.

You can import check draft history from your current check draft software, Bank Draft Software or Demand Draft Software.

Employee/Staff Access Level and Beyond

Bulk Check Draft in one Click, import and print, Group it and print, Set Recurring

Support Three Per page, Check on Top, Middle, Bottom

Send Signature Capture Link (Auto Signature Capture Options after a certain Amount)

Fraud prevention with QR Code by phone instantly

Advance searchable reports

End to end encryption in the Amazon cloud, Special Banking Grade security

Do you know?

Americans write four times more checks than Europeans

Frequently Asked Questions

Who Uses Check Draft, Checks By Phone, Fax, Online or “Pay By Check” Button on Websites?

Government Entities to Collect Tax and Fees.

General business

Insurance

Law Firms

Accountant Firm / CPA

Religious Establishments

Non-Profits

Cities and Counties

Apartments & Landlords for recurring Rent

Housing Associations

Is this same as ACH or EFT?

No both are Deferent. Check Draft do not need signature and must be accepted by bank. Check Draft do not have any transaction fee, Gateway fee or a percentage fee like ACH and EFT. Check Draft is just like a check. All you require a standard PC and an internet. You require a printer additionally to print check draft once created. OnlineCheckDraft.Com is a cloud-based software with military-grade security hosted in Amazon Banking type Server and ready to use in minutes when you verify bank and submit all documents required.

How This Works?

After you sell your item/Service, or any service agreement or Donation,

You get Clients’ Bank Account Number, routing number and verifiable authorization via Telephone/Web/Fax/Text/Link and keep this authorization safely in case any dispute comes. Authorization by a Link is recorded in your account however check and ensure. Enter that data to online Check Draft and print check Daft. Deposit this check draft just like a check to your bank. There is no any difference between check draft and check. Yet, check draft does not require a signature and you must have consent for that from them. We generally suggest having a paper trail like fax or text or email, for repeating recurring please select RECURRING and enter the number of event and recurrence. Check Draft will be prepared at that each time and ready to print. An easy way of collecting lease with no charge like credit cards and ready to print each time. No stress over forgetting.

(Used to collect /Rent/lease, month to month charge, Property Taxes, affiliation expense, Donation to your religious/501 C foundation/Accounting Fee/Insurance Payment/Association Fee).

Can I login Using my QuickBooks or Intuit Account?

You can log in to OnlineCheckDraft using Intuit Credentials. At Log in /Sign Up Page select Log in by Intuit. You can also log in or sign up using Amazon, Paypal, Microsoft, LinkedIn, Google Credentials.

How to Accept Checks over the Phone?

Banking regulations require some confirmations from clients for checks drafts. These avoid “the burden of proof” if a draft is disputed, it is required that such phone calls be recorded or confirmation of the authorization be mailed, faxed or emailed to the customer before the draft is initiated

Having the client email, fax or Text/SMS you a copy of a check with a signature that shows the same amount and payee as the draft you will create is the best and safest way. If that’s not possible, please follow following script according to banking regulations that will make sure you are in compliance.

Verbal Authorization that must be recorded or Authorization Mailed/Faxed/Emailed to Customer BEFORE the Draft is initiated.

After getting all Check information, please confirm this with clients.

We would like to verify your authorization for this check draft

Do you, [bank account holder or authorized signer] understand that the information you provided during this phone call that has taken place on [today’s date] at [time of call including time zone] will be used to create a onetime check draft (if it is recurring, as per your both party agreement) on the checking account for which you have provided information and are an authorized signer on the account?

[Wait for customer response]

Do you authorize us [or state your company’s name] to process a draft against said checking account in the amount of [amount of draft] and understand the draft will be dated and will be processed on or after [today’s full date or agreed to date of check/draft]?

[Wait for customer response]

Do you acknowledge that we have provided you with our phone number of [provide phone number] that is available and answered during normal business hours for your inquiries regarding this transaction?

[Wait for customer response]”

How to accept a check by phone?

This is the easiest way to take a check. You do not have to wait for checks to come in the mail from your client. You get all the information from your client like Bank routing number account number and enter into the software. Then you print the check by any printer on behalf of them with their authorization. This check will not have a signature and it states ‘No signature required. Approved by the depositor”. Deposit this check Draft to the bank just like you deposit a regular check. Please make sure to have a record of that. You can do it for a one-time payment, recurring payment open for various payment according to the agreement you have with your clients.

Do I need special printer and printer toner to Print Check Draft, ( Bank Draft or Demand Draft)?

Many US bank is using Optical check reader (OCR) today which can scan the checks printed on blank stock with regular office/home laser printers. After Check 21 Law (The Check Clearing for the 21st Century Act (Check 21) Checks are allowed to replace by image (Substitute Checks) for faster Processing through images. By creating a digital check image, it is able to fast-track processing using the “Check 21” system already in use by most banks. Most of the banks today have updated scanning technology and do not require the MICR after Check21 Act. There are Many Banks and check cashing places still keep MICR Reader, Have not replaced yet to OCR Reader. Be that as it may, Atm Deposits and Mobile Deposits and all officially through OCR perusing and VIA Image process

What is MICR?

MICR stands for Magnetic Ink Character Recognition; unlike regular laser toner, MICR toner contains iron oxide.

The use of MICR Toner may incredibly speed up the handling of your printed checks. The majority of the printer you have at home or office may have MICR Toner easily available in the market (just Toner-You don’t need to change the whole printer). Search your printer model online for MICR toner. It is much the same as a normal toner, however, Iron Oxide blended in the toner. After printing, nobody comes to know any deference yet readable by a MICR reader.

How can I deposit a Printed Check or Check Draft?

Printed Checks can be deposited on four ways

Mobile Deposit: Download your bank App(Bank of America, Chase Bank, Capital One, Citi Bank and so forth.) Deposit your Check by taking an image of it inside the App.

ATM: Printed Checks Draft can be deposited at an ATM of Your Bank. Not all the ATM capable to do that.

Taking to a Bank: Your Printed Checks Drafts are legally valid and just like a check to be presented at the bank for Deposit. Non-acceptance at bank counters is rare, but if it happens please use any of the alternate methods e.g. Deposit Online, Mobile phone deposit, ATM etc.

Remote Deposit Capture (RDC). It allows a customer to scan checks remotely and transmit the check images to a bank for deposit, usually via an encrypted Internet connection. Banks typically offer RDC to business customers rather than to individuals

Can I Add my company Logo?

You are printing actually the check of your clients. But the difference is it is not required to have their signature, so instead of check, it is called check draft or Bank draft or even demand draft. You don’t know most of the case what is the logo of your clients. So there is no point of your logo on that check. Your focus to get paid on time with your client’s proper authorization.

Can my Clients Add Signature Electronically?

Yes. You can add the electronic signature of your client into that check You printing. It is the best way to have an extra layer of security also. All you have to do is send the link which is already pre-made in the software to that customer in one click to their smartphone or email. Once he signs in that link you will see that signature appeared on that check draft. Basically then it is called check not check draft anymore. And it is more secured way.

Can I import check draft data of my clients from Excel?

Yes, You can import your check draft data from Excel and import into our system and print.

Let’s Start now for free.

No Credit card. Cancel any time you need

Join With 100 Thousand Plus

© 2018 Online Check Writer LLC

Products

Program