Check Draft Software

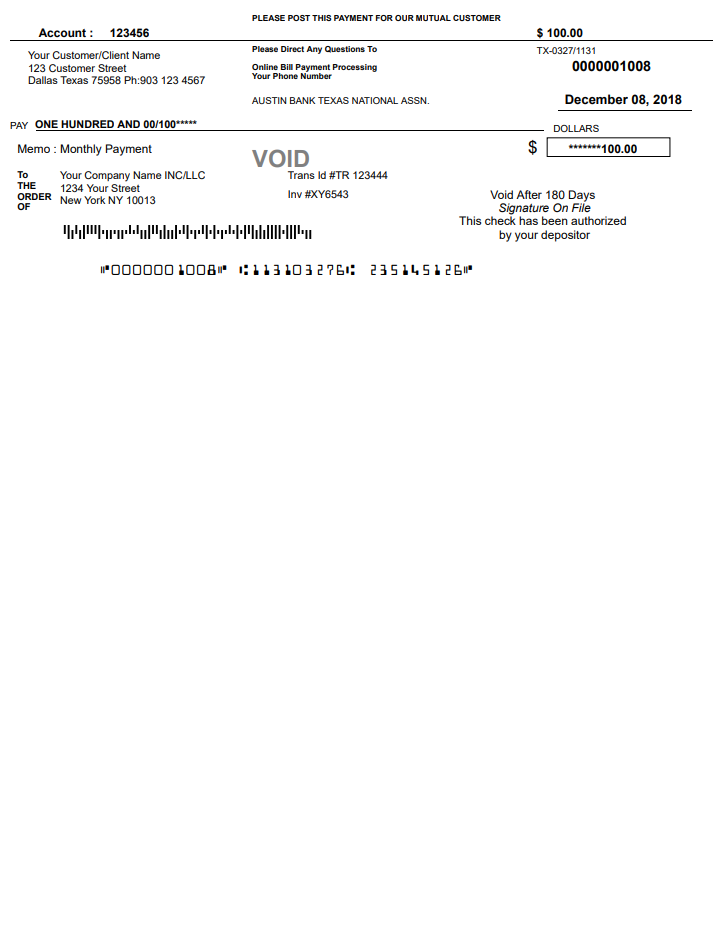

Printed By Merchant on Behalf of Payer, No Signature Required.

Cloud-based check Draft software. Print Check Draft in few minutes

Any Printer, Any Check Paper, Anywhere. Support Check on Top, Middle, Bottom, Three Per Page.

What is actully Check Draft?

Many businesses still don’t know what is checked draft. Check draft often called Bank draft or demand draft.

But there are many out there who takes advantage of the check draft. It is same as a check but printed by merchants on behalf of players with proper permission. No Signature Required.

Results are you don’t have to wait for check in the mail, you don’t have to pay any kind of processing fee of credit card Companies.

Is Check Draft legal?

Yes, printing checks from your own printer

Uniform Commercial Code – Reference: Title 1, Sections 1-201 [39] and Title 3, Sections 3-103a, 3-104, 3-401, 3-402, and 3-403. Federal Trade Commission – Reference: Telemarketing Sales Rule – Title 16, Section 310.3 (a)(3). Code of Federal Regulations – Reference: Title 12 Chapter II, Part 210. Federal Reserve Bank – Reference: Regulation J, Part 2, Sections 4a-201 to a-212.

A Checks you received by phone or fax, a block of text and printed as check draft, a block of text approved by the American Banking Association will appear instead of the signature. It is required by law to have a record of authorization from your client.

Federal Regulation regarding Printed Checks.

UCC regulations on Checks basically state that as long as a check conforms to the definition, it is a legal requirement for a bank to accept it when you present it to a bank teller. The bank(s) have some discretion on the amount of time they will hold the funds.

The Check21 definition https://www.fdic.gov/consumers/assistance/protection/check21.html states that a Check image reproduced cleanly in any paper is as valid as the original Check

Login From Anywhere

Our software is 100 % cloud-based. So you can log in from anywhere. You don’t need to download any software. Use OnlineCheckDraft.Com from anywhere, Macbook, Linux Operating System Even from your Phone. Do You know your data secured in the Industry leading Amazon Banking Grade server? We don’t want to take any risk on your valuable Data.

Feature : Online Check Draft Software

No Download required , could base Check writing software

Create multiple check Draft / batch check draft in one click

Every check Draft has its own statement

Print Deposit Slips also Online for the Checks Draft you created in one click.

Categorized Check Draft

Print check Draft from any Printer or Computer

Check Draft. Get paid over the phone, fax or web without any fee

Recurring Check Draft. Set it and will be ready to print at specified time.

You can import check draft history from your current check draft software, Bank Draft Software or Demand Draft Software.

Employee/Staff Access Level and Beyond

Bulk Check Draft in one Click, import and print, Group it and print, Set Recurring

Support Three Per page, Check on Top, Middle, Bottom

Send Signature Capture Link (Auto Signature Capture Options after a certain Amount)

Fraud prevention with QR Code by phone instantly

Advance searchable reports

End to end encryption in the Amazon cloud, Special Banking Grade security

Do you know?

Americans write four times more checks than Europeans

Frequently Asked Questions

Can I use Reg white Paper to print Check Draft?

It is not at all recommended to print checks or Check Draft on white paper. It will give you very much hard time at the bank even though checks are processed by OCR nowadays after the check 21 law. Use Any Blank check paper stock,

Blank check stock has security features which help prevent fraud.

You can purchase the blank check stock from any local office stores or Online, Amazon etc

Can I use regular printer to print Checks or Check Draft?

You can use any kind of printer you have already at home or office.

Most of the banks today have updated scanning technology and do not require the MICR after Check21 Act. Checks are allowed to process through image OCR for faster processing. Like you deposit the check by phone and At ATM machines. That is the reason these days you don’t get original checks any longer but a yellow replacement copy of checks which is in the same class as a legal copy of checks.

Mobile banking works today

Once the checks has been converted to an image, the presence of MICR ink on the original item may not be known downstream

MICR stands for Magnetic Ink Character Recognition; unlike regular laser toner, MICR toner contains iron oxide.

The use of MICR Toner may incredibly speed up the handling of your printed checks.

The majority of the printer you have at home or office may have MICR Toner easily available in the market (just Toner-You don’t need to change the whole printer). Search your printer model online for MICR toner. It is much the same as a normal toner, however, Iron Oxide blended in the toner. After printing, nobody comes to know any deference yet readable by a MICR reader.

The cost for MICR Toner cartridges will vary upon the model of the printer but will print a considerable number of checks because of the low utilization of toner per page of checks. For instance, the MICR Toner for an HP LaserJet 1100 sells for $40.00 to $50.00 with a normal page yield of roughly 2800 pages – that is around 8400 checks if it is a 3 Per page Checks.

What is Blank Check Stock or Blank Check Paper?

It is a letter size paper used for printing checks and check draft. You can purchase blank check paper from any local office supply store like Office Depot, OfficeMax, staple or online store like Amazon, walmart.com and many many authorized sellers. Always buy good quality blank check paper. It has several security features.

Can I login Using my QuickBooks or Intuit Account?

You can log in to OnlineCheckDraft using Intuit Credentials. At Log in /Sign Up Page select Log in by Intuit. You can also log in or sign up using Amazon, Paypal, Microsoft, LinkedIn, Google Credentials.

Do You Support Three Per Page Check paper to print three Check Draft per Page?

Yes. OnlinecheckDraft.Com support three per page check printing.

Do I need MICR Toner?

Most of the banks today have updated scanning technology and do not require the MICR after Check21 Act. Checks are allowed to process through image OCR for faster processing. Like you deposit the check by phone and At ATM machines. That is the reason these days you don’t get original checks any longer but a yellow replacement copy of checks which is in the same class as a legal copy of checks.

Mobile banking works today

Once the check has been converted to an image, the presence of MICR ink on the original item may not be known downstream

MICR stands for Magnetic Ink Character Recognition; unlike regular laser toner, MICR toner contains iron oxide.

The use of MICR Toner may incredibly speed up the handling of your printed checks.

The majority of the printer you have at home or office may have MICR Toner easily available in the market (just Toner-You don’t need to change the whole printer). Search your printer model online for MICR toner. It is much the same as a normal toner, however, Iron Oxide blended in the toner. After printing, nobody comes to know any deference yet readable by a MICR reader.

The cost for MICR Toner cartridges will vary upon the model of the printer but will print a considerable number of checks because of the low utilization of toner per page of checks. For instance, the MICR Toner for an HP LaserJet 1100 sells for $40.00 to $50.00 with a normal page yield of roughly 2800 pages – that is around 8400 checks if it is a 3 Per page Checks.

Do I need special printer and printer toner to Print Check Draft, ( Bank Draft or Demand Draft)?

Many US bank is using Optical check reader (OCR) today which can scan the checks printed on blank stock with regular office/home laser printers. After Check 21 Law (The Check Clearing for the 21st Century Act (Check 21) Checks are allowed to replace by image (Substitute Checks) for faster Processing through images. By creating a digital check image, it is able to fast-track processing using the “Check 21” system already in use by most banks. Most of the banks today have updated scanning technology and do not require the MICR after Check21 Act. There are Many Banks and check cashing places still keep MICR Reader, Have not replaced yet to OCR Reader. Be that as it may, Atm Deposits and Mobile Deposits and all officially through OCR perusing and VIA Image process

What is MICR?

MICR stands for Magnetic Ink Character Recognition; unlike regular laser toner, MICR toner contains iron oxide.

The use of MICR Toner may incredibly speed up the handling of your printed checks. The majority of the printer you have at home or office may have MICR Toner easily available in the market (just Toner-You don’t need to change the whole printer). Search your printer model online for MICR toner. It is much the same as a normal toner, however, Iron Oxide blended in the toner. After printing, nobody comes to know any deference yet readable by a MICR reader.

What is Bank Identification Number? Bank Fractional Number?

Bank identification number often called Bank fraction number. After check 21 law Bank fraction number is not much used anymore. It is not mandatory to have it on the check or a check draft to process the check.

The prefix (no longer used in check processing, yet still printed on most checks) is a 1 or 2 digit code (P or PP) indicating the region where the bank is located. … For example, a check from Wachovia Bank in Yardley, PA, has a fraction of 55-2/212 and a routing number of 021200025.

A fractional is used to determine the financial institution of the share draft if the MICR line is ever damaged or torn off:

The fractional number goes like this: XX-YYYY/ZZZZ.

ZZZZ is the first 4 digits of your routing number (you can skip the leading zeroes).

YYYY is the next 4 digits of your routing number (the last, 9th digit, is control digit).

XX is the city/state where the bank is located (I believe its based on the original HQ, I know that for WF in California its 11, which is San Francisco). You can find the full list on Wikipedia, once the blackout is over (in the mean time – call your Congressman and voice your objections to SOPA).

Can I Add my company Logo?

You are printing actually the check of your clients. But the difference is it is not required to have their signature, so instead of check, it is called check draft or Bank draft or even demand draft. You don’t know most of the case what is the logo of your clients. So there is no point of your logo on that check. Your focus to get paid on time with your client’s proper authorization.

Can my Clients Add Signature Electronically?

Yes. You can add the electronic signature of your client into that check You printing. It is the best way to have an extra layer of security also. All you have to do is send the link which is already pre-made in the software to that customer in one click to their smartphone or email. Once he signs in that link you will see that signature appeared on that check draft. Basically then it is called check not check draft anymore. And it is more secured way.

Can I import check draft data of my clients from Excel?

Yes, You can import your check draft data from Excel and import into our system and print.

Let’s Start now for free.

No Credit card. Cancel any time you need

Join With 100 Thousand Plus

© 2018 Online Check Writer LLC

Products

Program